D+W Individual Portfolios

Dauble+Worthington also offers individual strategies to diversify your existing portfolio.

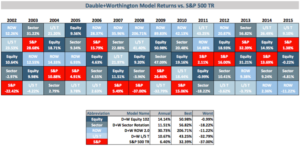

Click the graphic above to view a full size table with important disclosures.

D+W Equity 102

D+W Equity 102 seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows our proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific stocks. This model follows long term signals to evaluate individual stocks.

Download Tear Sheet

Download Tear Sheet

D+W Sector Rotation

D+W Sector Rotation seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific mutual funds in the ProFunds Ultra Sector series which include leverage. It may invest in, and may shift frequently among these funds and money markets.

Download Tear Sheet

Download Tear Sheet

D+W Sector Opportunities

D+W Sector Rotation seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific efts. It may invest in, and may shift frequently among these efts and money markets.

Download Tear Sheet

Download Tear Sheet

D+W ROW 2.0

D+W ROW 2.0 seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific mutual funds through ProFunds which include leverage and short positions. It may invest in, and may shift frequently among these funds and money markets.

Download Tear Sheet

Download Tear Sheet

D+W L/S T

D+W L/S T seeks to maximize return through capital appreciation with low correlation to broad market indices. D+W L/S T is short for Long/Short Treasury. The model identifies changing price trends in U.S. treasuries and invests accordingly. The model seeks to achieve its investment objective by investing in specific mutual funds through ProFunds which include leverage and short positions.

Download Tear Sheet

Download Tear Sheet