D+W Blended Portfolios

Dauble+Worthington offers a wide range of blended portfolio options to meet the needs of most investors. Please click the “Download Tear Sheet” button under each description to download a .pdf tear sheet with more information and important disclosures.

D+W Total Strategy

D+W Total Strategy incorporates a combination of multiple portfolios offered through Dauble+Worthington Equity Portfolios. Using our proprietary long, intermediate, and short term signals, we are able to adapt to changing market environments to protect assets while also focusing on growth.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -4.73% | -5.10% | -0.24% | 1.46% | 6.15% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Dynamic Opportunities

D+W Dynamic Opportunities is a blended portfolio consisting of four models. The first and second models focus on identifying the strongest sectors of the equity markets. The third model focuses on identifying short term trends and fluctuations in the S&P 500. The fourth model takes advantage of the changing trends in U.S. treasury prices. These four non-correlated models are constantly monitored to determine the weight of their allocation in the portfolio.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -4.23% | -1.38% | 3.37% | 2.42% | 6.38% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W 60/40

Formerly known as D+W Sectors with L/S T, D+W 60/40 is a new take on a tired investment philosophy. Unlike a passively managed traditional 60% equity 40% fixed income mix, we actively manage both the equity and fixed income allocations. Our “60/40” portfolio is made up of a combination of our D+W Sector Rotation and D+W L/S T models.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -7.83% | -3.29% | -0.22% | 4.82% | 9.19% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Dynamic

D+W Dynamic is a blended portfolio consisting of three models. The first model focuses on identifying the strongest sectors of the equity markets. The second model focuses on identifying short term trends and fluctuations in the S&P 500. The final model takes advantage of the changing trends in U.S. treasury prices. These three non-correlated models are constantly monitored to determine the weight of their allocation in the portfolio.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -5.97% | -1.45% | 0.53% | -1.31% | 4.36% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Total Equity Strategy

D+W Total Equity Strategy seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific stocks, sector mutual funds and etfs. It may invest in, and may shift frequently among these stocks, mutual funds and etfs.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -0.38% | -7.20% | 1.78% | 2.21% | 7.82% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Sector Strategies

D+W Sector Strategies seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific sector mutual funds and etfs. It may invest in, and may shift frequently among these mutual funds and etfs.

| Performance data is annualized if over one year.* | Updated: | 03/31/23 | ||

| YTD | 1 year | 3 year | 5 year | 10 year |

| -0.03% | -0.44% | 8.45% | 7.83% | 11.09% |

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear Sheet*3 year, 5 year, and 10 year performance may include hypothetical performance. Please use the button below each table, “Download Tear Sheet”, to view performance data and important disclosures.

D+W Individual Portfolios

Dauble+Worthington also offers individual strategies to diversify your existing portfolio.

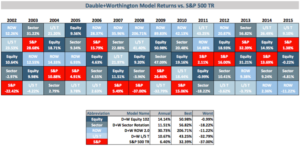

Click the graphic above to view a full size table with important disclosures.

D+W Equity 102

D+W Equity 102 seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows our proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific stocks. This model follows long term signals to evaluate individual stocks.

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Sector Rotation

D+W Sector Rotation seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific mutual funds in the ProFunds Ultra Sector series which include leverage. It may invest in, and may shift frequently among these funds and money markets.

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W Sector Opportunities

D+W Sector Opportunities seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific etfs. It may invest in, and may shift frequently among these etfs and money markets.

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W ROW 2.0

D+W ROW 2.0 seeks to maximize return through capital appreciation with low correlation to broad market indices. The model follows proprietary trend and relative strength indicators and seeks to achieve its investment objective by investing in specific mutual funds through ProFunds which include leverage and short positions. It may invest in, and may shift frequently among these funds and money markets.

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet

Complete Tear Sheet Updated Monthly

Download Tear SheetD+W L/S T

D+W L/S T seeks to maximize return through capital appreciation with low correlation to broad market indices. D+W L/S T is short for Long/Short Treasury. The model identifies changing price trends in U.S. treasuries and invests accordingly. The model seeks to achieve its investment objective by investing in specific mutual funds through ProFunds which include leverage and short positions.

Riskalyze Tear Sheet Updated Quarterly

Download Tear Sheet

Download Tear Sheet